Moving through DYCO PR and its associated styles, practices, and methods, we’ll be exploring this unique form of blockchain PR. By the end of this article, you’ll have all of the information you need to know about how to run successful campaigns every single time.

We’ll be covering:

- What a DYCO is

- What went wrong with ICOs

- Best Practises for a DYCO PR Launch

Let’s get right into it.

What is a DYCO?

Standing for Dynamic Coin Offering, DYCO is a specific source of blockchain crowdfunding that was invented by the Decentralized Autonomous Organization (DAO) Maker. The central purpose of a DYCO is to raise money, with these platforms offering utility tokens that are directly backed by USD for the first 16 months of their running.

Being backed by USD allows any investors that participate in these fundraising schemes to refund any of the tokens that they’ve minted throughout the course of the project. This is to actively create a sense of accountability for the project, ensuring that it does what its promising – otherwise it won’t make any money.

If an investor sees that the project isn’t meeting the expectations that the DYCO event promised, then they can return their USD backed currency. Doing this will burn the tokens, adjusting the value of the coin as it does so. While the investors will get the amount they invested back, the coin itself will rise in value.

With burning the only option for those that leave the project, there will be a decreased number of coins available, ensuring that their value is proportionally increased to the percentage of the total supply that was burnt. While this ensures investors have much less risk, being pegged to the USD also makes sure that there is a limit on downwards movement, while it has the potential to continuously climb if doing well.

DYCO Buybacks

Another core element of DYCO token sales are buy backs. These are events through which the price of the token change due to buying and burning. These buyback periods allow the DYCOs to issue more of the utility tokens. Over these 16 months, there are three distinct buyback periods:

- First Buyback – The first buyback will be 9 months after the Token Generation Event.

- Second Buyback – The second buyback will be 12 months after the Token Generation Event.

- Third Buyback – The third buyback will be 16 months after the TGE.

The spacing of these events is to give enough time for the project owners to demonstrate that the period is viable and will be on-track to hit the goals that have been laid out. Quite simply, if people think that the project isn’t going well, then no one will engage with the buybacks, causing the team behind the project to have to put up their own capital to cover the claims.

A core part of DYCO PR will be organizing media campaigns around these buyback events, ensuring that there are investors willing to put down their capital. Throughout these buybacks, if the team doesn’t perform, an investor can reclaim all of their money, effectively shifting even more pressure onto the project.

If people trust in the project, the people already within the project won’t claim anything back on the buybacks, ensuring that the team then has even more capital to advance their project. This system is tied to how well the product is doing, with the successful projects being able to access funding while those that don’t live up to standards having to put up capital themselves.

This system is constructed to directly fight the lack of accountability and rug pulls that ICO projects were experiencing.

What went wrong with ICOs?

All crypto PR campaigns have elements of ICO PR at their core. The only key difference is that many of the new fundraising strategies that have arisen are directly reacting to what went wrong with ICOs, hoping to create a more reliable and trustworthy system.

While ICOs seemed to be a great idea when they came out, opportunistic scammers ruined this source of fundraising, creating projects, promising high returns, then running off with investor money. This was so common that 81% of all the ICOs released in 2018 turned out to be complete scams.

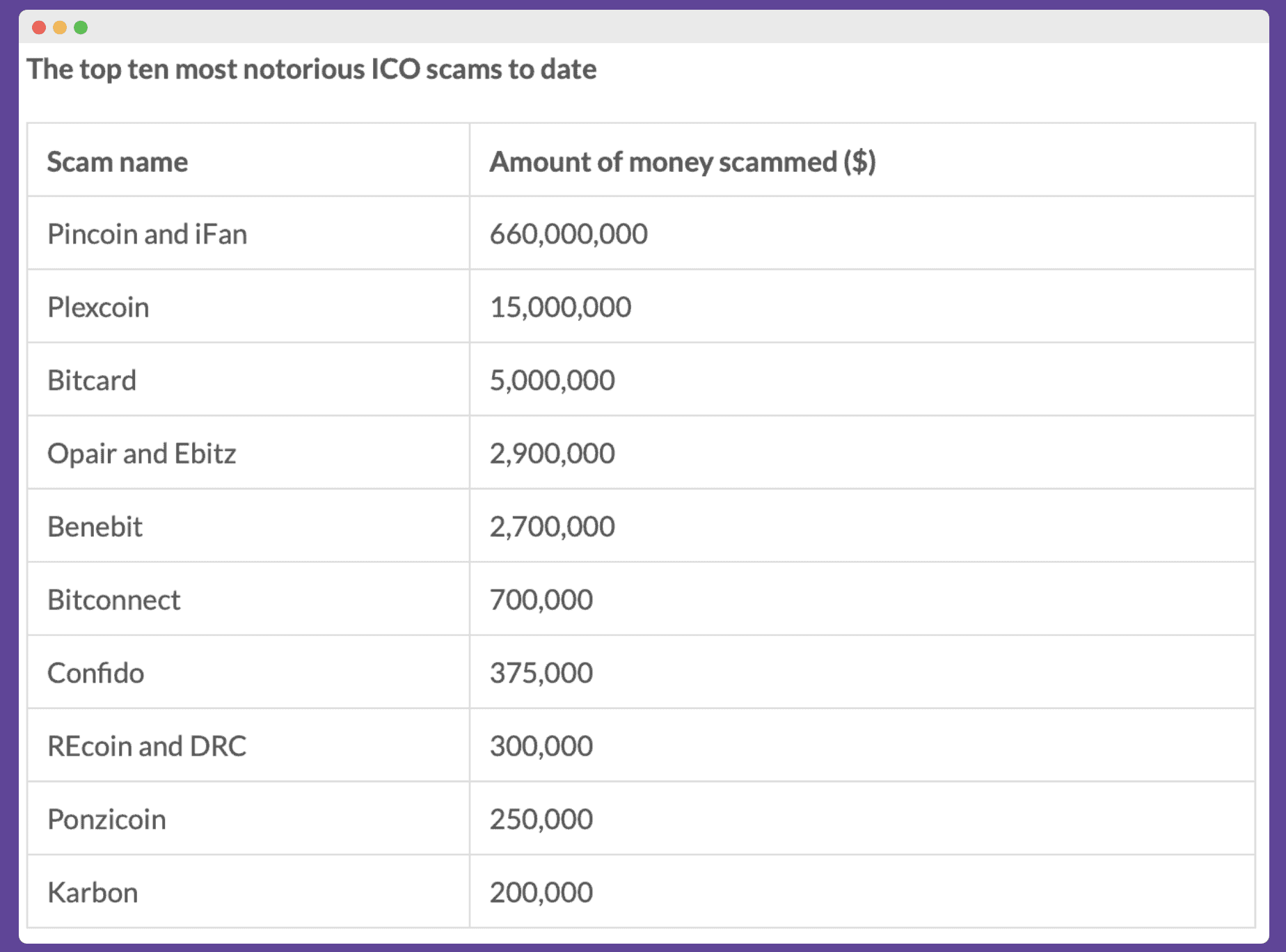

Some of the largest ICO scams raked in millions of USD in stolen funds, with Pincoin and iFan taking $660,000,000. While this is the largest ICO scam, it is far from the only one.

Considering the high amount of ICO scams that were appearing, it’s no wonder that investors around the globe started to consider the whole cryptocurrency industry a complete scam. With rug pull after rug pull occuring on a daily basis, investors needed a new way to fundraise money that didn’t have such a dark history.

From that position, many new formats of blockchain fundraising have arrived, with DYCO being one of them.

Best Practises for a DYCO PR Launch

- Break Down the Concept

- Continuous Updates

- Use SEO Within Content

- Interviews and Podcasts

Let’s break these down further.

Break Down the Concept

While the majority of the cryptocurrency community now understand ICOs to some extent, there is much less of a chance that everyone you come across will be familiar with the concept of a DYCO. Considering that this is one of the most recent crypto fundraising constructions, many people have never heard of this format.

Due to this, before launching into advanced vocabulary or skirting right on past the concept, you need to designate time to actually explaining how your project is going to work in simple terms. Good DYCO PR is all about taking something that is still fairly unknown and breaking it down into simple terms.

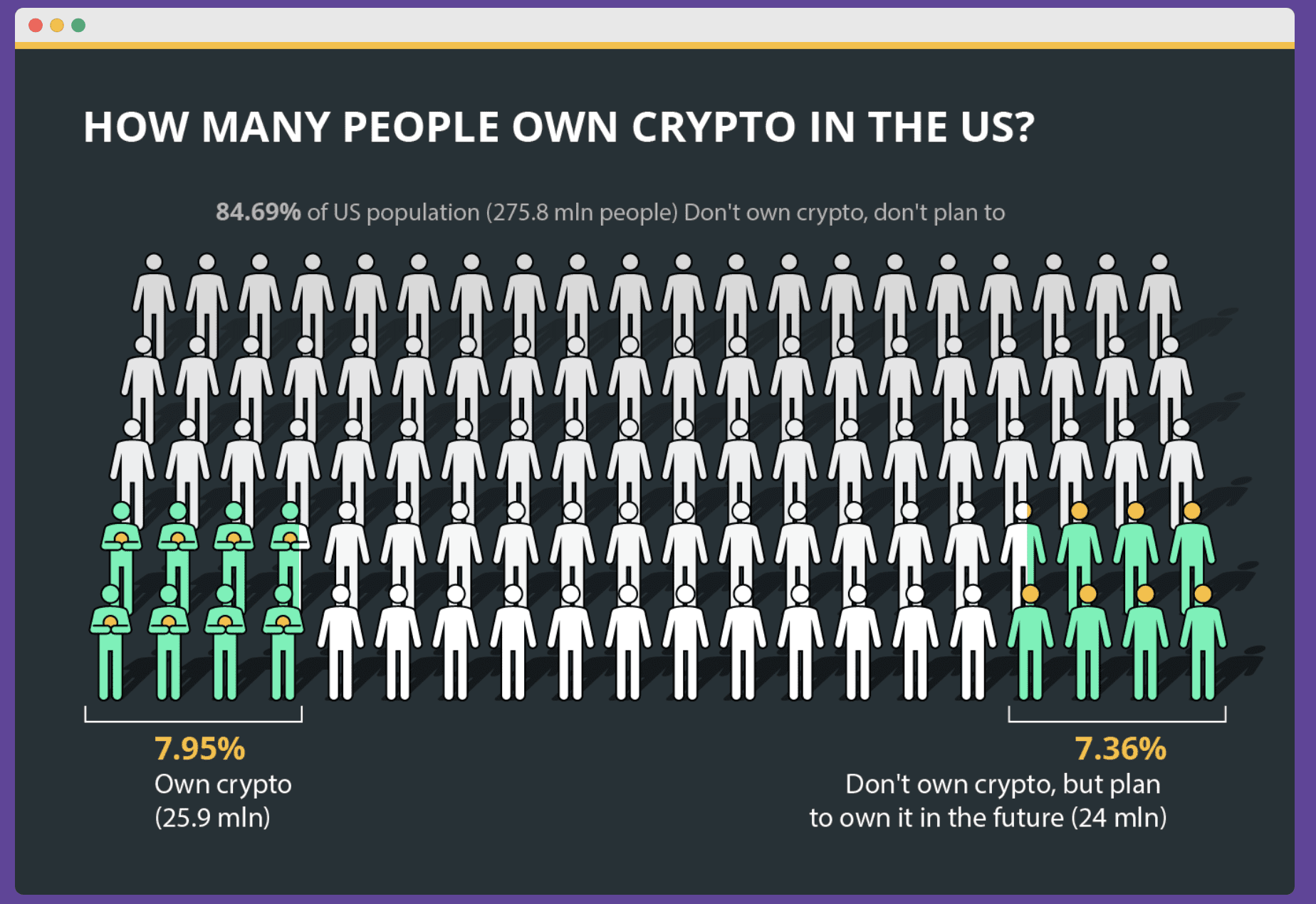

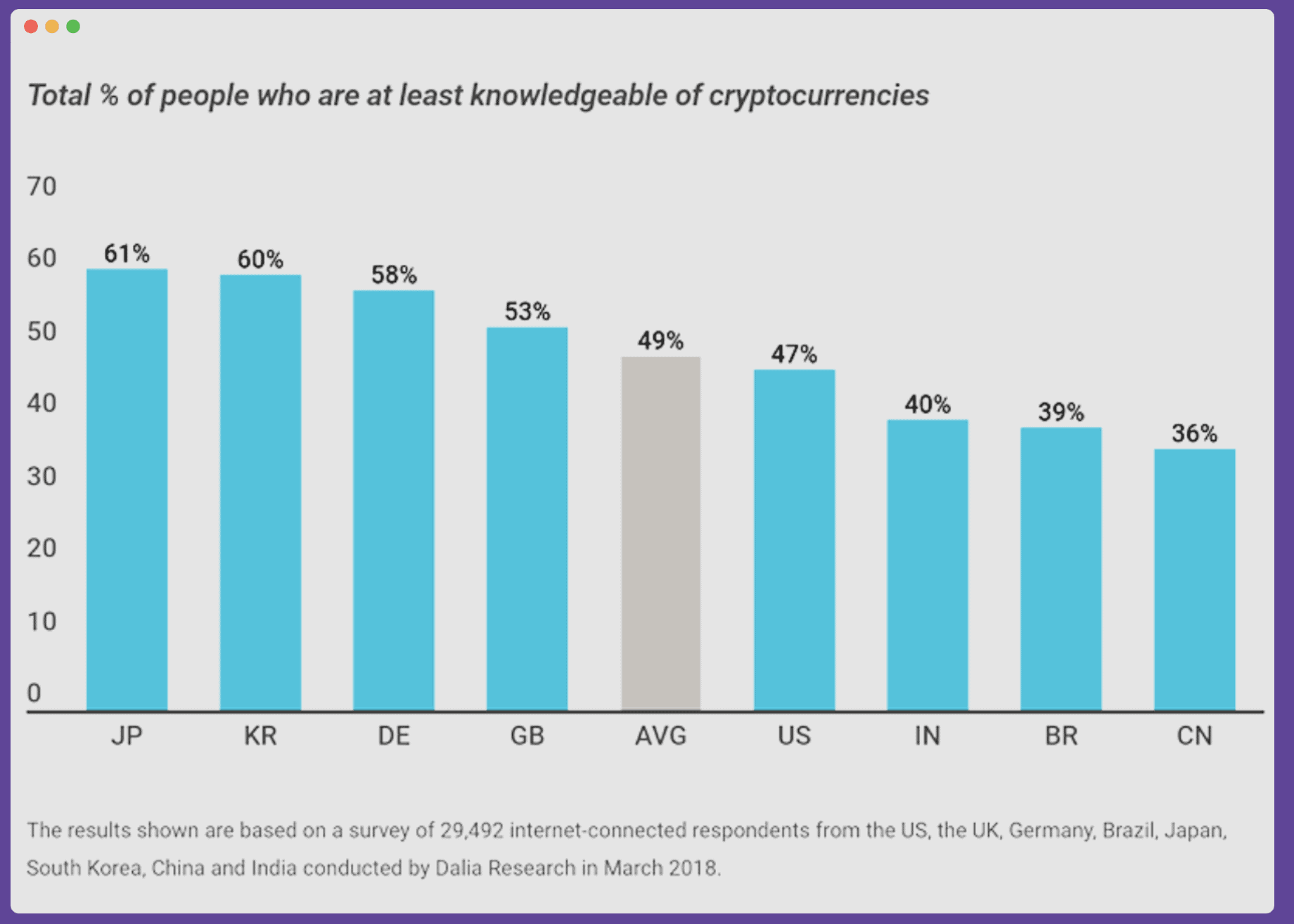

This is a great practise across the whole genre of crypto PR. Considering that only 57% of Americans have ever even heard of cryptocurrency, there is a very high chance that someone who stumbles across your project might not have any clue what’s going on.

That’s why you should always take your ideas back to basics, provide lots of documentation of your project, and explain in simple terms what you’re aiming to do, how you’re going to deliver it, and how long it’s going to take.

Continuous Updates

An essential part of running a DYCO PR campaign is to make sure that you’re as transparent about your progress as possible. Considering that there are three buyback rounds, there are three potential moments where your campaign can get incredibly more expensive as people decide that they have no faith in your project.

If you’re looking to run a successful DYCO PR campaign, one of the most important aspects is ensuring that your audience is continuously informed with the active progress of your business. There are a few different ways to go about this, but two always rise to the top as the best practises that you can engage in.

These are:

- Email Newsletters

- Weekly Article Updates.

Let’s break these two formats of updating your investors down.

Email Newsletters

Newsletters are an effective way of directly communicating with a certain audience. In this case, when asking for investments for your DYCO project also extend the invite for users to sign up for your email newsletter.

Within this newsletter, you’ll break down the progress of your project every single week, ensuring that there is a documented history of the development of your ongoing project. With this, you’re able to effectively trace your development, demonstrating to your investors that your project is on the right track.

With this, everyone will know that the team behind the investment pool is actively working on the project, helping to make sure that as few people as possible engage in buybacks when the time comes around.

Weekly Article Updates

A weekly update in the form of an article will provide a centralized location where your investors, and anyone else curious about the project, can go to see how effective the project is being. This provides a great location to talk about your project and have its developing over time, publishing it in this more public forum to cater to a bigger audience.

Especially considering even email subscribers are fairly unlikely to open email newsletters, with only 25% of users doing so regularly, article writing is a great way to go.

We recommend that you use these two strategies in tandem, creating a more holistic system where people have access to recent information about your project whenever they would like it.

Interviews and Podcasts

Cryptocurrency is still a relatively unknown medium of investment for a long of people around the globe. This isn’t even considering DYCO, which is a much more specific form of investment within this industry. Due to the low number of people that actively know about cryptocurrency and are willing to invest and trade it, you should do everything you can within your DYCO PR campaign to get the word out about your project.

One way of doing this is to expand the possible mediums that people will find your project through. While engaging in traditional PR avenues like social media will be beneficial, there are also some less-used strategies that work well within DYCO PR campaigns.

A strategy that we recommend is finding podcast and interview opportunities for your founder or CEO to engage with. Going on a podcast gives you between 30 minutes and one hour to prove the importance of your project to an audience. Not only does this large amount of time provide ample opportunity to explain the benefit of your project, but it also exposes you to a whole new audience, and perhaps a new sector of investors.

Equally, as investments within the world of blockchain have a slightly negative history attached to them, many people will really benefit from seeing the human side to your project. Getting a charismatic voice in front of the microphone will go a long way in humanizing your project, helping you to pull investors that you may not have even considered possible.

Final Thoughts on DYCO PR

As a modern form of public relations, DYCO PR needs unique and inventive tactics to prove the validity of projects and secure investors for the long term. Due to the much safer USD-backed system that this investment scheme uses, the main goal of projects is to demonstrate how well your project is currently doing.

Especially around buyback periods, DYCO PR agents need to focus on getting the message out there that the project is progressing as it should, with the more impressive the progress being resulting in fewer people using the buyback system and helping your project to continue with more capital.

If you’re looking for a helping hand with your DYCO PR, then get in contact with GuerrillaBuzz for a quote. We’re experts in this field, and will be able to walk you through the whole process.

About the Author

Yuval is a savvy SEO and marketing expert with over a decade of experience. Specializing in the blockchain industry, he's the go-to guy for crypto companies looking to simplify their digital marketing strategies and achieve explosive growth. As a digital nomad and successful company builder, Yuval brings a fresh, creative perspective to every project he tackles.